Business Insurance in and around Aiea

One of the top small business insurance companies in Aiea, and beyond.

This small business insurance is not risky

Insure The Business You've Built.

Running a small business is no joke. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of contractors, trades, specialized professions and more!

One of the top small business insurance companies in Aiea, and beyond.

This small business insurance is not risky

Customizable Coverage For Your Business

When one is as enthusiastic about their small business as you are, it is understandable to want to make sure everything is in order. That's why State Farm has coverage options for artisan and service contractors, worker’s compensation, business owners policies, and more.

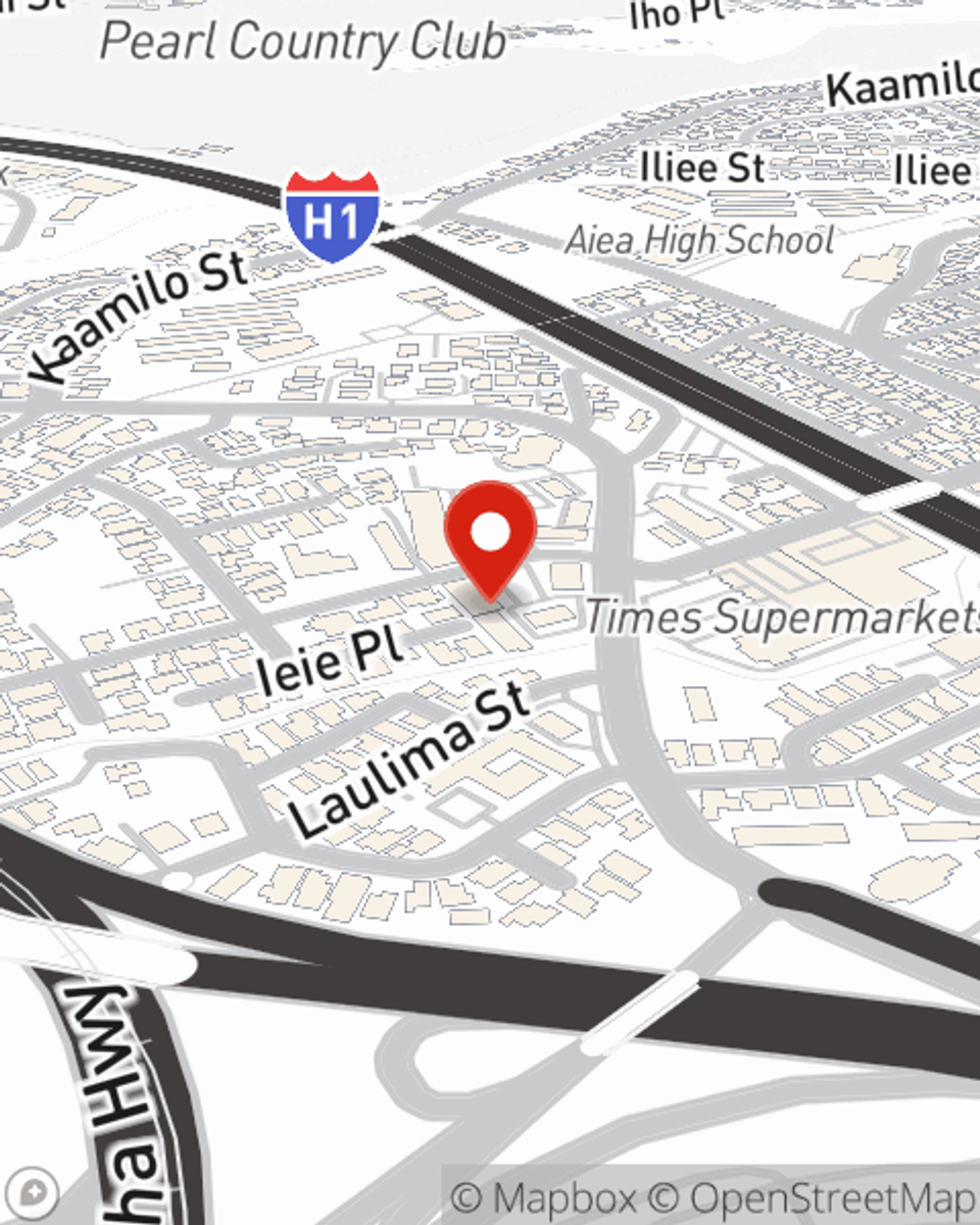

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Thomas Jansson is here to help you discuss your options. Get in touch today!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Thomas Jansson

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.